Pvm Accounting for Dummies

Table of ContentsWhat Does Pvm Accounting Do?Getting The Pvm Accounting To WorkThe Facts About Pvm Accounting RevealedThe Main Principles Of Pvm Accounting Getting My Pvm Accounting To WorkEverything about Pvm Accounting

Look after and handle the creation and approval of all project-related billings to customers to foster excellent interaction and prevent problems. Clean-up bookkeeping. Ensure that appropriate records and documentation are sent to and are updated with the IRS. Make certain that the audit procedure abides by the legislation. Apply needed construction bookkeeping standards and treatments to the recording and coverage of building activity.Understand and keep standard cost codes in the accounting system. Connect with different funding companies (i.e. Title Company, Escrow Business) pertaining to the pay application process and demands needed for settlement. Handle lien waiver dispensation and collection - https://spotless-pea-22d.notion.site/Demystifying-Construction-Accounting-Your-Ultimate-Guide-5f9fc548c683420fabff40afc3d0c8fe. Display and fix financial institution problems consisting of charge abnormalities and check differences. Assist with applying and keeping inner financial controls and procedures.

The above declarations are intended to describe the basic nature and degree of job being carried out by people appointed to this classification. They are not to be construed as an extensive listing of obligations, obligations, and abilities required. Employees might be called for to carry out duties outside of their regular responsibilities periodically, as needed.

The 8-Minute Rule for Pvm Accounting

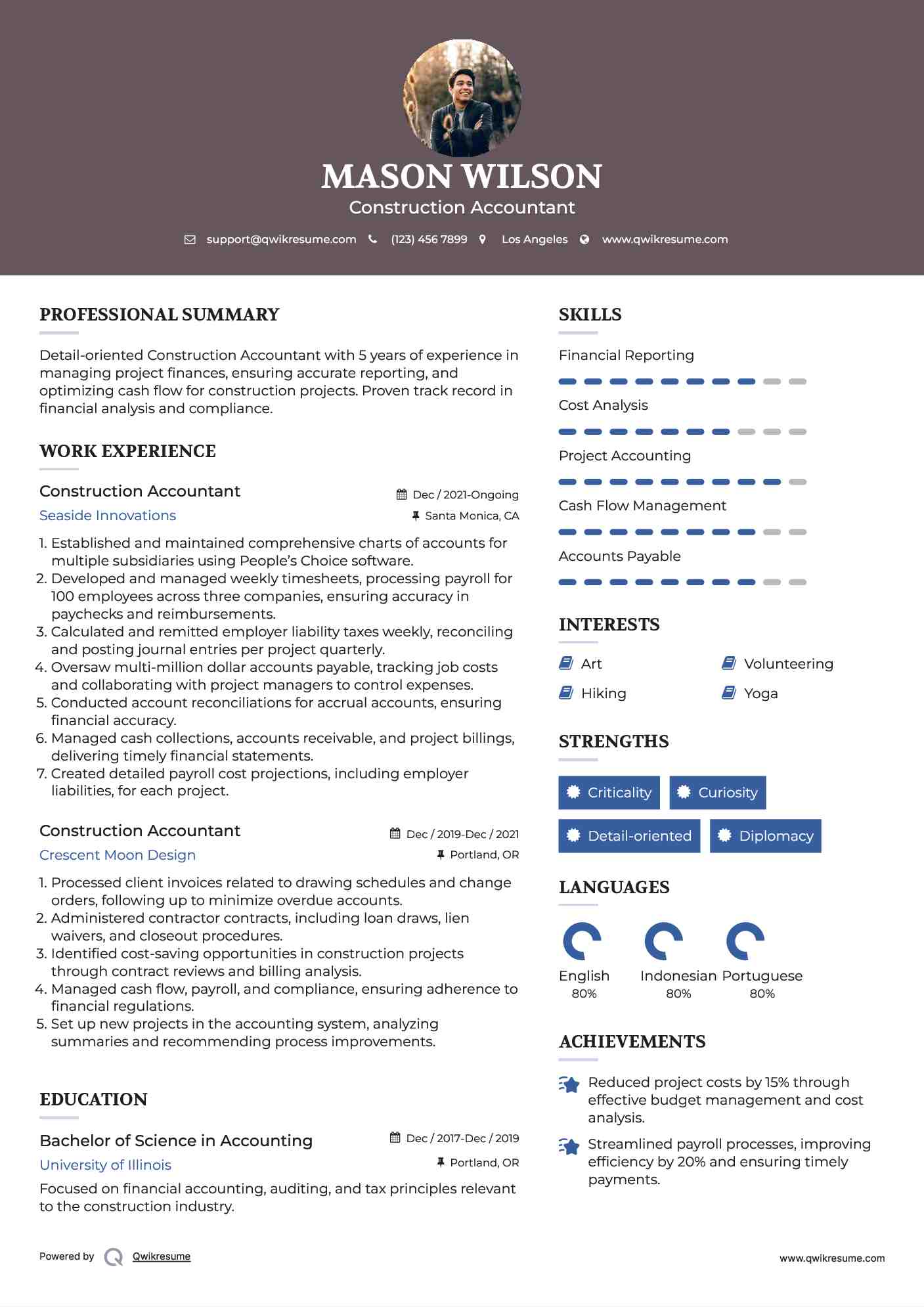

You will certainly aid support the Accel team to ensure distribution of effective on time, on spending plan, projects. Accel is seeking a Building Accounting professional for the Chicago Office. The Construction Accounting professional executes a selection of audit, insurance compliance, and job administration. Functions both independently and within particular divisions to keep financial documents and make certain that all records are kept current.

Principal duties consist of, yet are not restricted to, dealing with all accounting functions of the business in a prompt and precise fashion and providing reports and schedules to the firm's certified public accountant Company in the preparation of all monetary statements. Guarantees that all bookkeeping treatments and features are handled properly. Accountable for all financial documents, pay-roll, banking and daily operation of the audit feature.

Prepares bi-weekly trial equilibrium reports. Works with Task Supervisors to prepare and post all month-to-month billings. Procedures and issues all accounts payable and subcontractor repayments. Generates regular monthly recaps for Employees Payment and General Responsibility insurance coverage premiums. Generates regular monthly Task Cost to Date reports and collaborating with PMs to fix up with Task Supervisors' allocate each task.

Pvm Accounting - Questions

Proficiency in Sage 300 Building and Property (previously Sage Timberline Office) and Procore construction management software an and also. https://www.kickstarter.com/profile/pvmaccount1ng/about. Should additionally be proficient in various other computer software application systems for the prep work of records, spreadsheets and various other bookkeeping analysis that might be required by management. construction bookkeeping. Have to have strong organizational abilities and ability to prioritize

They are the economic custodians who make sure that construction projects stay on spending plan, conform with tax obligation laws, and preserve economic transparency. Construction accountants are not simply number crunchers; look at this site they are tactical companions in the building procedure. Their main function is to handle the monetary elements of construction projects, ensuring that sources are designated effectively and monetary risks are minimized.

Things about Pvm Accounting

They function carefully with task managers to produce and keep an eye on budget plans, track expenses, and forecast monetary needs. By maintaining a limited grasp on job funds, accounting professionals aid protect against overspending and monetary obstacles. Budgeting is a foundation of successful building projects, and building and construction accounting professionals are critical in this respect. They produce detailed spending plans that include all project expenses, from products and labor to licenses and insurance coverage.

Building accountants are well-versed in these guidelines and ensure that the project complies with all tax needs. To succeed in the role of a building accounting professional, individuals require a strong educational foundation in bookkeeping and finance.

Additionally, certifications such as Licensed Public Accounting Professional (CPA) or Certified Construction Sector Financial Specialist (CCIFP) are extremely regarded in the sector. Building and construction jobs typically include limited due dates, altering regulations, and unanticipated costs.

About Pvm Accounting

Professional certifications like CPA or CCIFP are also highly advised to demonstrate know-how in building and construction audit. Ans: Building accountants create and keep an eye on budget plans, determining cost-saving opportunities and ensuring that the task remains within spending plan. They also track expenditures and forecast monetary needs to avoid overspending. Ans: Yes, building accountants take care of tax compliance for building and construction projects.

Introduction to Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make challenging selections among numerous financial options, like bidding process on one job over an additional, selecting financing for products or equipment, or setting a job's revenue margin. Construction is a notoriously unstable sector with a high failure price, slow-moving time to repayment, and inconsistent cash circulation.

Manufacturing includes duplicated processes with quickly recognizable expenses. Manufacturing requires different procedures, materials, and devices with differing costs. Each job takes place in a new area with varying site problems and special challenges.

Getting My Pvm Accounting To Work

Frequent use of different specialized professionals and providers impacts performance and cash flow. Settlement gets here in complete or with normal settlements for the complete contract amount. Some section of settlement may be kept until project conclusion also when the professional's job is ended up.

While typical makers have the benefit of controlled settings and enhanced manufacturing processes, building and construction business have to continuously adjust to each new job. Even rather repeatable projects need alterations due to site problems and various other aspects.

Comments on “An Unbiased View of Pvm Accounting”